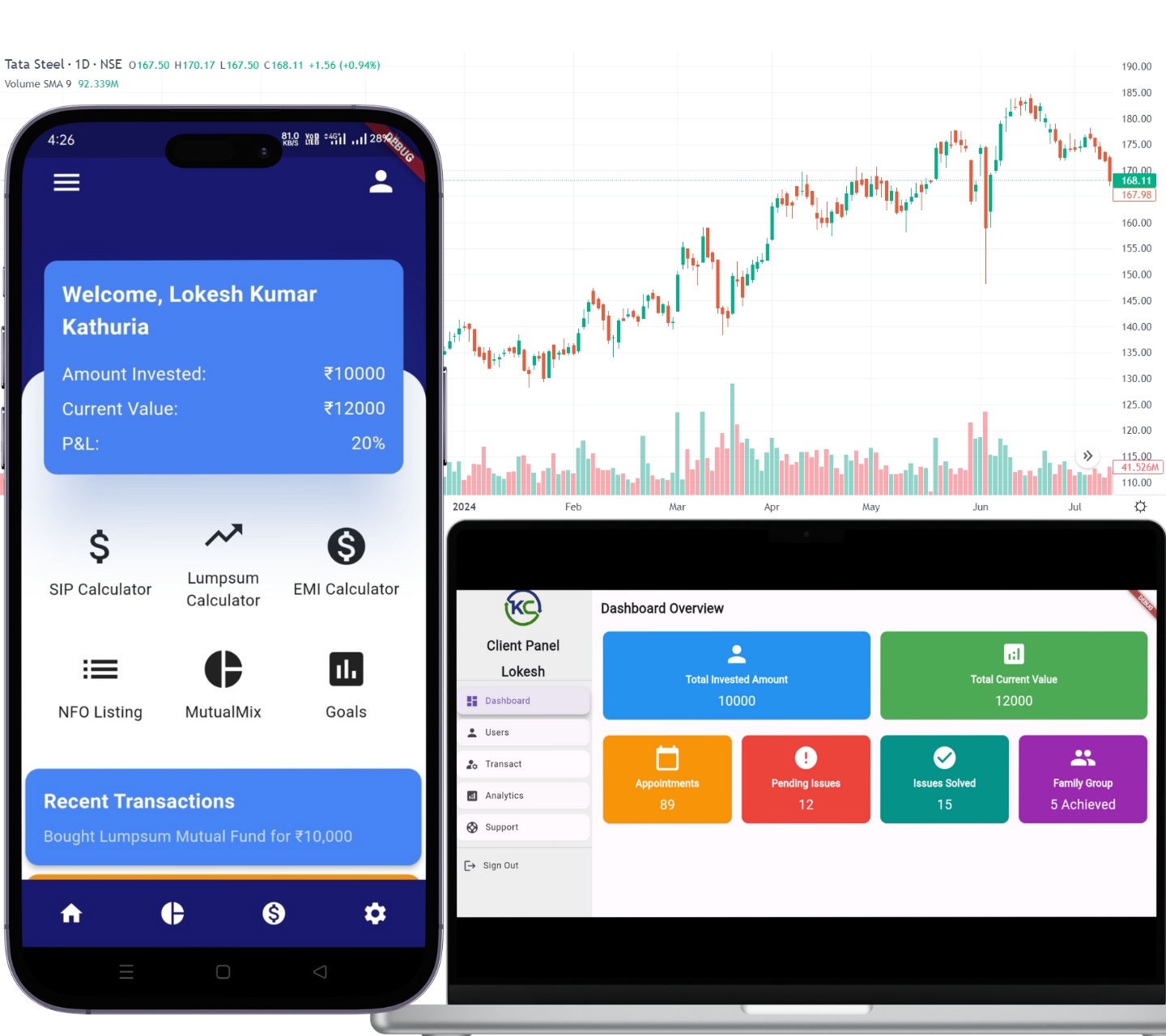

Welcome to KC Investment

Unlock your financial potential with our modern and intuitive platform. your financial future start here

Why Invest with Us?

Why Invest with Us?

With a history of over 15 years and hundreds of clients we are the go to destination for all financial decisions.

Our Investment Products

Our Investment Products

Investment Calculator

Calculate Your Returns

Use sliders to estimate your investment returns over time.

FAQ

Frequently Asked Questions

Find answers to common questions about our services and investment strategies.

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

When you invest in a mutual fund, your money is combined with that of other investors, and a professional fund manager manages the investments.

Types include equity funds, bond funds, balanced funds, index funds, money market funds, and specialty funds.

Benefits include diversification, professional management, liquidity, affordability, and convenience.

Costs can include expense ratios, load fees, and transaction fees.

Consider factors like investment goals, performance history, fees, and the manager's experience.

While they can be safer due to diversification, mutual funds are not risk-free and vary in risk depending on the type.

Returns include capital gains, dividends, and NAV appreciation.

Taxation depends on the type of fund and investor’s tax situation, with capital gains and dividends being taxable.

Yes, many retirement accounts allow investments in mutual funds, which can help grow retirement savings.

Testimonials

Testimonials

Necessitatibus eius consequatur ex aliquid fuga eum quidem sint consectetur velit